Challenge

The real estate tax reform is just around the corner. It is expected that from mid-2022, real estate tax returns will have to be submitted by the owners of approximately 36 million properties in Germany. The necessary data must be collected and compiled from various sources and formats (digital / paper). Depending on the regulations of the respective federal state in which the real estate is located, a variety of data is identified, searched and declared. Using scarce in-house personnel resources for this purpose, or even increasing the number of staff, does not appear to be expedient.

BDO Grizzly

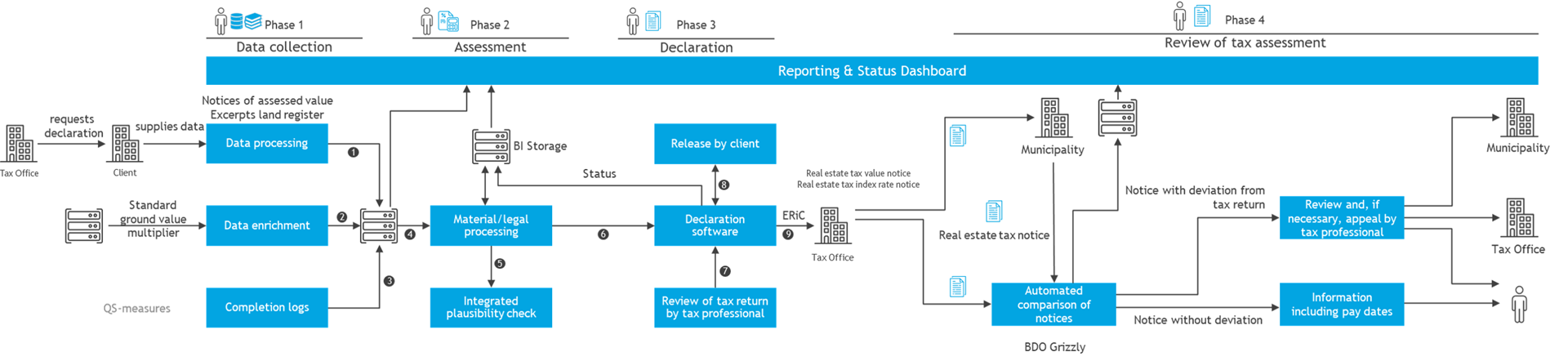

In response, BDO has developed the BDO GRIZZLY service offering in recent months. BDO GRIZZLY is an integrated service approach that begins with data collection and extends to the review of notifications. In developing BDO GRIZZLY, we have been guided by the need to develop everything digitally and online, to reduce the burden on our clients' resources and, through high efficiency and strong expertise, to minimize compliance risks and material real estate tax risks.

Platform, reporting and dashboard

The BDO GRIZZLY lives in a digital ecosystem. All data is centrally stored in our BDO Data Center in Hamburg and can be accessed via the BDO Portal. This is also where the data exchange between you and BDO is carried out.

In the BDO Portal, you can check the current status of a project at any time by using the Report & Status Dashboard. Especially with a large number of objects, overview and monitoring are essential.

Indication of real estate tax

How much more (or less) real estate tax can I expect? This question concerns many property owners. The BDO GRIZZLY offers indications here, always based on the most current data and information available.

Data collection to review of tax assessment

The BDO GRIZZLY covers the complete process from data collection and material legal processing to tax returns and the review/audit of tax returns.

Reporting & Status Dashboard

During a preliminary project, BDO will record the current situation of your company and your real estate with regard to the data situation and the real estate concerned.

After the preliminary project, we jointly draw up a project plan to ensure a targeted and efficient approach to data collection and the transfer of data to BDO GRIZZLY.

Throughout the duration of the project, the responsible partner is always available to you as a point of contact.

Why BDO – Your advantages

- Your paper documents >> Our scan center can handle this and extract data via OCR text recognition.

- Your digital data >> Our IT experts analyze your entire database and provide the necessary interfaces to transfer your data into BDO Grizzly.

- Your questions >> Our real estate tax experts are available to provide advice.

- Your scarce personnel resources >> Our fully integrated digital process approach promises high efficiency and a low resource drain on your side.