IPO project management aided by an IPO advisor

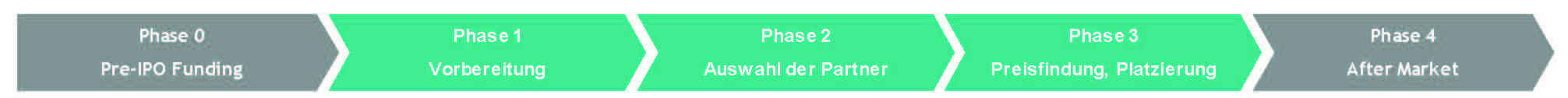

The core of an IPO process can be divided into three phases with respect to its critical issues and milestones, plus an upstream pre-IPO and the downstream post-IPO phase.

A private placement prior to an IPO and, depending on the individual situation of the company, a more or less intensive phase 1 can hardly be represented in standardised schedules. Moreover, the choice of the stock exchange (for example: Deutsche Börse, London Stock Exchange, NYSE, Nasdaq OMX US, NYSE Euronext Europe …), the specific market stock exchange segment (in Germany: Prime Standard and General Standard on the Regulated Market and the Open Market) and the consideration of dual/cross listings on multiple exchanges are authoritative for an individual process planning and scheduling of the IPO.

An IPO is a unique challenge for any management board, but most of all demanding in terms of time and content. And both daily operations and the development of the company are of particular importance in the IPO year. They are critically questioned by analysts and investors in terms of the credibility of the plan and therefore of the entire equity story. It is therefore obvious that daily operations should not suffer due to the actual IPO process.

Specially appointed, internal and external IPO management can mean significant relief. Although this service is often offered as a component in the context of an overall package by the consortium of investment banks, many companies choose an independent IPO advisor at an early stage; that is, before selecting the appropriate consortium. The reasons for this are the greater cost efficiency and credibility achieved by the independence of the advisor in their position as an advisor and sparring partner. The inclusion of an experienced IPO advisor in your choice of additional partners and the investment bank in the bank beauty contest boosts your options for reducing what are significant IPO costs at a decisive point.